Many academics have tried to construct factor models with broad explanatory power of asset returns. The most successful and popular of these models do so consistently and with as few parameters as possible. In other words, a model with 4 factors is preferable to a model with 18 factors even if they have the same explanatory power.

Recent growth in the factor zoo has led to similar growth in the number of factor models seeking to explain returns, but there are really only four factor models worth paying attention to. They are the Capital Asset Pricing Model (CAPM), the Fama-French Three Factor Model, the Carhart Four Factor Model, and the Fama-French Five Factor Model.

Basic Factor Investing Series

- Introduction to Factor Investing

- Popular Multi-Factor Models (3, 4, and 5 factor models)

- How to Tell Good Factors From Bad: Taming the Factor Zoo

- How Do We Know Factor Premiums Will Persist?

- In Depth: Beta

- In Depth: Size Factor

- In Depth: Value Factor

- In Depth: Momentum Factor

- In Depth: Quality Factor

- In Depth: Low Volatility Factor

- Other Factors You Can Probably Ignore

- Fundamentals of Factor Portfolio Construction

- How to Calculate Your Portfolio's Factor Loadings (Exposure)

- Best in Class Factor Funds and ETFs

- Four Sample Factor Portfolios

Capital Asset Pricing Model (CAPM)

The CAPM is the granddaddy of all performance attribution models. It isn't used by academics to explain returns anymore due to the development of far more complete factor models, but I'm including it here because it was so influential on everything that came after.

Introduced in the mid 1960s by the luminaries of modern finance like Markowitz, Sharpe, and Traynor, the CAPM forms the backbone of modern portfolio theory and contains only a single factor, Beta. In the CAPM, beta represents an asset's sensitivity to non-diversifiable market risk, meaning it can't be reduced any further simply by adding more stocks to a portfolio.

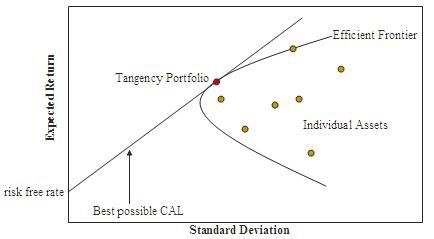

The CAPM is the origin of the concept of the Efficient Frontier, which is a method of optimizing risk and return. There's a theoretical curve on which it is impossible to earn more return without taking on more risk. You can increase return by increasing risk, or reduce risk by decreasing return, but they remain intrinsically linked no matter which direction you go. The advent of broad market index investing follows directly from the CAPM as the primary tool used to move up and down the efficient frontier.

The CAPM explains about 70% of the returns of a diversified stock portfolio, which implies 70% of your portfolio's return is determined by how much stock you hold. The remaining 30% is attributable to other factors and investor skill. Until the advent of the Fama-French three factor model, most of this chunk of return was attributed to alpha, or manager skill.

Fama-French Three Factor Model

Eugene Fama and Kenneth French published a landmark paper in 1992 introducing the world to the Size and Value factors. It was a major leap forward over the CAPM because it explained roughly 90% of a diversified portfolio's return compared to just 70% for the CAPM. Almost overnight, two-thirds of the alpha in the money management universe turned out to be compensation for risk clients didn't even know they were taking rather than manager skill. Money managers were not amused.

The factors are:

- Beta

- Value (HML) - The return of the 30% cheapest stocks by P/B minus the return of the 30% most expensive stocks by P/B.

- Size (SMB) - The return of the 50% smallest stocks by market cap minus the return of the 50% largest stocks by market cap.

Although the original study focused on the US stock market, subsequent research has shown the model is equally effective in explaining the returns of the stock markets of other countries. The magnitudes of the factor premiums differ from country to country, but they exist and are fairly accurate at explaining returns.

Carhart Four Factor Model

Published in 1997, the Carhart Four Factor Model builds on the Fama-French Three Factor Model. The addition of the Momentum (UMD) factor to the Three Factor Model's Beta, Size, and Value factors boosted the explanatory power of the model to 95% vs the 90% of the Three Factor Model.

The factors:

- Beta

- Value (HML)

- Size (SMB)

- Momentum (UMD) - The return of the equal weighted average of the 50% highest performing stocks minus the return of the equal weighted average of the 50% lowest performing stocks. The momentum factor is a bit controversial in that there are convincing risk-based as well as behavioral-based explanations. The factor is definitely real, but the question of why it exists is not entirely settled. We'll dig into this distinction in our deep dive into the Momentum factor.

Fama-French Five Factor Model

Fama and French published their Five Factor Model in 2013. Like the Carhart Four Factor Model, the Five Factor Model also explains roughly 95% of portfolio returns. Instead, of the Momentum factor, it introduces the Profitability (RMW) and Investment (CMA) factors.

The factors:

- Beta

- Value (HML)

- Size (SMB)

- Profitability (RMW) - The return of stocks with high operating profitability minus the return of stocks with low or negative operating profitability. The Profitability factor is often subsumed by the more holistic Quality (QMJ) factor, of which operating profitability is a major component. While it is not accurate to say the Profitability and Quality factors are interchangeable, they do tend to be highly correlated and you wouldn't go too far wrong in thinking of them as close variations on a theme.

- Investment (CMA) - The return of the stocks of companies that require little on-going capital investment to maintain and grow their businesses minus the return of the stocks of companies that require large on-going capital investment. The Investment factor is strongly negatively correlated with Value and, taken together with Profitability, can be thought of as related to the Quality factor.

One problem for the Fama-French Five Factor Model is that it doesn't appear to provide a workable explanation of stock returns in the UK according to some researchers.

What About <Insert Factor Here>?

The Carhart Four Factor and Fama-French Five Factor models are the workhorses are modern finance. That said, they don't contain every factor. Indeed, there are over 300 factors in the academic literature, including some very popular ones such as Low-Volatility and Quality that don't appear in any of these models. Where do those factors fit in?

Unfortunately, they don't. This is a problem because the mainstream factor models give us a ready-made mathematical framework to easily compare the factor exposure and forecast premium expectations between different portfolios in a way that ad-hoc factor combinations don't. Could you add factor zoo entry #173 to the Four Factor Model and compare the results across multiple portfolios? Sure, but you'd need to blaze your own path and make sure to avoid the numerous pitfalls of such an approach. If you stick to the mainstream models, on the other hand, there are a plethora of free tools online that take care of all that stuff for you. Given the Four- and Five Factor models already explain 95% of the cross section of portfolio returns, I've decided there's limited practical benefit to rolling my own. On the other hand, if I managed a $1 billion hedge fund, that would be different.

Some tools such as portfoliovisualizer.com do allow you to run factor regressions against AQR and Alpha Architect data sets, which do include factors like Quality and Betting Against Beta.

Check out the rest of our series on the basics of Factor Investing below!

Basic Factor Investing Series

- Introduction to Factor Investing

- Popular Multi-Factor Models (3, 4, and 5 factor models)

- How to Tell Good Factors From Bad: Taming the Factor Zoo

- How Do We Know Factor Premiums Will Persist?

- In Depth: Beta

- In Depth: Size Factor

- In Depth: Value Factor

- In Depth: Momentum Factor

- In Depth: Quality Factor

- In Depth: Low Volatility Factor

- Other Factors You Can Probably Ignore

- Fundamentals of Factor Portfolio Construction

- How to Calculate Your Portfolio's Factor Loadings (Exposure)

- Best in Class Factor Funds and ETFs

- Four Sample Factor Portfolios